Discover the Potential of DeFi-Enhanced FIRE Strategies (DeFIRE)

Explore how DeFi can help you achieve FIRE faster

Imagine retiring years earlier than expected, with financial security and the freedom to travel the world or pursue your passions. This isn't a pipe dream, but a real possibility through Decentralized Financial Independence Retire Early (DeFIRE) - an innovative financial and retirement planning strategy rooted in Decentralized Finance (DeFi).

You can't get rich easy, however, certain ways make you rich quicker than other ways. - MJ DeMarco

Incorporating DeFi into your investment strategy can provide several benefits, such as flexibility in managing assets, geographical arbitrage, possibilities to achieve a higher fixed rate of return, diversification, and adaptability.

Evolution is about solving problems with technology - you need to adapt.

This article will explore various DeFi strategies to achieve financial independence and early retirement, emphasizing the innovative and transformative aspects of DeFi in the context of FIRE. It will provide practical guidance and lower-risk DeFi strategies that can be added to your FIRE arsenal, helping you achieve financial independence and the lifestyle you've always dreamed of.

The outdated nature of the current pension and work system

The increasing life expectancy of people globally has led to a rise in pension ages. In the Netherlands, for instance, researchers predict that the pension age will exceed 70 years in the next decade. This trend is accompanied by a steady rise in the amount of wealth required to enjoy a comfortable retirement, as pension benefits are often indexed to inflation.

Furthermore, the traditional pension model assumes that all retirees have the same financial needs and circumstances. In reality, this could not be further from the truth - people's post-retirement expenses vary greatly depending on factors such as health status, lifestyle choices, and debt levels. It is becoming clear that this model is no longer fit for purpose.

Today, we don’t have the same level of risk tolerance. People want an extremely high level of safety, but they don’t realize we can be too conservative.

Being too conservative on safety actually leads to systemic risk.

Systemic risk happens when you stop taking risks and get stuck with a system that no longer improves.

- Balaji Srinivasan

Reflecting on this, the idea of working throughout one's life and only enjoying the last part when they are less vital seems increasingly bizarre.

This reality hit home when my father-in-law, a dedicated and hardworking individual, was diagnosed with pancreatic cancer as he is approaching his retirement age. He expressed regret over not having spent more time with his children due to his work commitments. This personal experience highlighted the paradox of working tirelessly for a distant retirement that may be compromised by health issues.

It underscored the importance of finding a balance between work and personal life throughout one's lifetime, rather than deferring enjoyment to a later, potentially less vibrant, stage.

It is essential for individuals to find a balance between work and personal life throughout their lives and consider alternative ways to secure their financial future during retirement, such as saving more, investing wisely, and exploring alternative sources of income.

The FIRE movement

One such approach to achieving financial independence and early retirement is the Financial Independence Retire Early (FIRE) movement, which has gained significant traction in recent years as more people seek financial freedom and the ability to retire early through (extreme) saving and investing.

The FIRE movement is inspired by a.o. the book Your Money or Your Life by Vicki Robin and Joe Dominguez. In summary:

The goal is to save up to 70% of your annual income to retire early and live off small withdrawals (3-4% p.a.) from accumulated funds. Achieving financial independence means having enough financial resources to cover living expenses without having to be employed or dependent on others. Everyone achieves financial independence differently depending on their personal preferences, income, relationships, location, and other factors.

I want to stress that FIRE is not solely about saving and investing but also about enjoying life and experiencing new things. Yes, It requires dedication, financial discipline, and a willingness to make significant lifestyle changes, but the aim is to have the financial freedom to lead the desired life. The ultimate goal is to achieve financial flexibility, allowing individuals to have more control over how they spend their time and money. I view "early retirement" as an opportunity to pursue full-time activities and interests that bring joy, such as spending time with loved ones, traveling, reading, analyzing, writing, and designing cool stuff.

There are different FIRE variations such as:

Fat FIRE: A more easygoing approach that involves saving more while giving up less;

Lean FIRE: This variation focuses on minimalist living and requires devotion to a simple lifestyle;

Barista FIRE: Aiming to retire early while still taking on a side gig or part-time work to supplement income; and

Coast FIRE: Saving and investing enough to stop contributing to retirement savings but still having enough funds to cover living expenses.

DeFIRE: Adding decentralized digital assets in the mix

I want to add another variation here, Decentralized FIRE (or DeFi-enhanced FIRE). Digital assets, cryptocurrency, or decentralized finance (DeFi) are oftentimes not in the vocabulary of the traditional FIRE movement, as it is seen as a speculative investment, and perhaps with valid reason.

However, institutional investors are increasingly interested in digital assets and blockchain technology, with many planning to allocate 1% to 5% of their portfolios to these assets.

DeFi refers to a suite of financial applications built on blockchain technology that aims to recreate and improve upon traditional financial systems. DeFi applications are typically built on top of a blockchain, such as Ethereum, and are often open source, meaning that anyone can access and use them. In order for DeFi dApps to work, it usually requires collateral to be locked into smart contracts, and the cumulative collateral locked in DeFi dApps is often referred to as the Total Value Locked (TVL).

Traditional methods of saving and investing often involve centralized institutions such as banks and brokerages, but with the rise of cryptocurrency and DeFi, there's a new way for individuals to pursue FIRE that offers increased control, security, and potential for higher returns.

Incorporating DeFi to the FIRE mix can provide several benefits, including:

Flexibility in managing assets: With self-custody and decentralized solutions, individuals have more control over their investments and can easily move funds between various DeFi applications to optimize returns, manage risks, or access new opportunities as they arise.

Geographical arbitrage: DeFi allows you to take advantage of differences in costs between two geographic locations, enabling you to earn income in a strong currency and spend in a weaker currency. (e.g. living in a lower-cost location can significantly reduce your expenses, allowing you to save more money).

Possibilities to achieve a higher fixed-rate of return: DeFi provides various financial applications that can help users earn fixed-rate yields on their investments. This can be useful for FIRE enthusiasts who want to generate passive income and maintain a stable financial portfolio.

Diversification: DeFi can offer diversification benefits, as it allows users to invest in a wide range of assets and protocols (and traditional methods). This can help spread risk and provide a more stable passive income streams.

Adaptability: DeFi is a rapidly evolving field, with new protocols and applications being developed constantly. This adaptability can help FIRE investors stay ahead of market trends and potentially achieve higher returns on their investments, which reduces the time to reach their FIRE milestone.

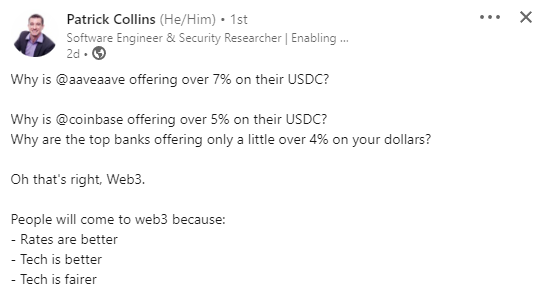

Patrick Collins also summarizes the better rates on DeFi (Aave protocol) compared to CeFi (Coinbase) and TradFi (banks):

Given that decentralized finance (DeFi) is still considered an emerging market, the interaction with decentralized applications (dApps) within DeFi carries various risks, such as smart contract risk, increased volatility, and potential scams. Investors should be compensated for these increased risks, which justifies the higher yield earned via DeFi. Diversifying investments across multiple DeFi platforms is essential for risk management.

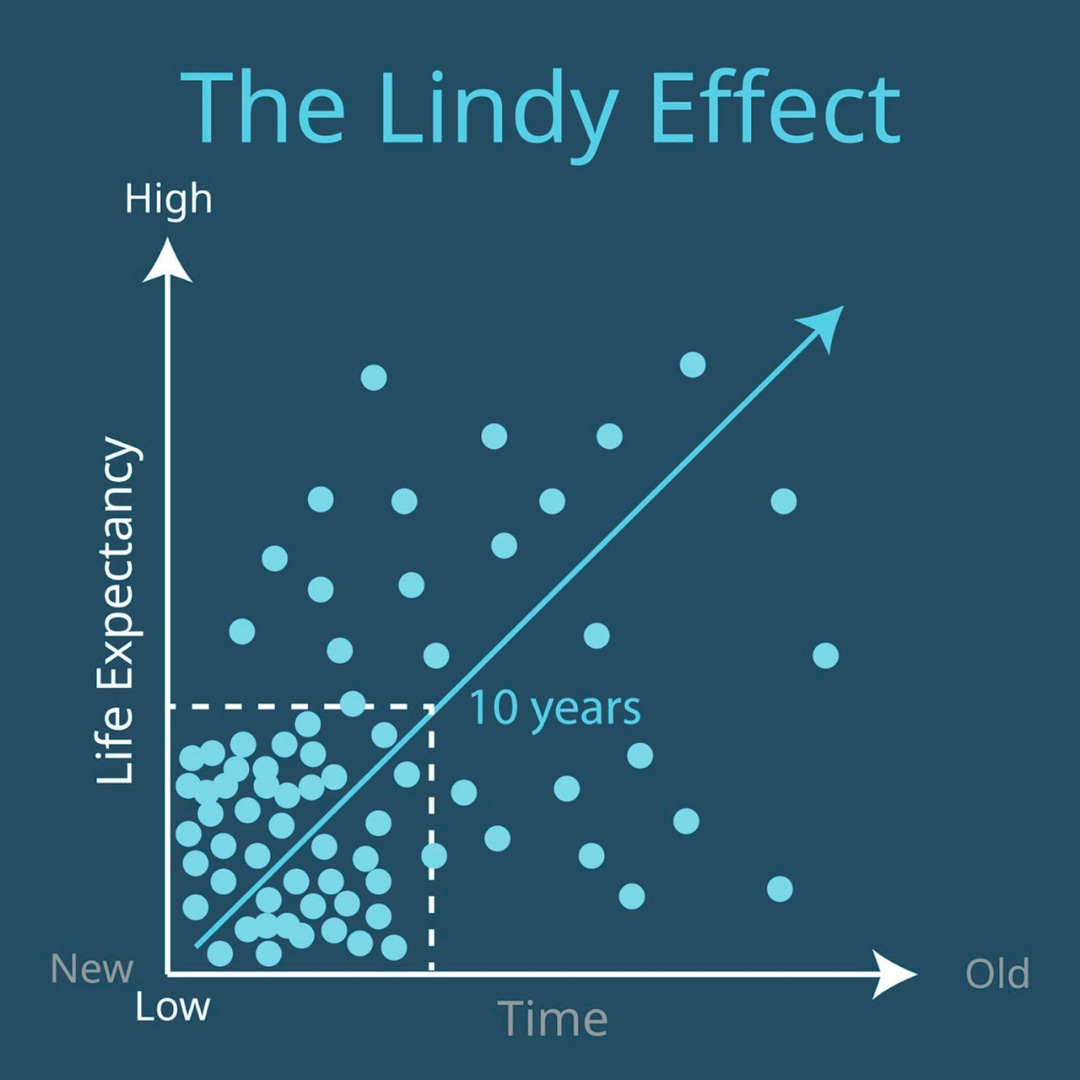

The Lindy Effect, a concept that suggests the longer a non-perishable item has been around, the longer it's likely to persist into the future, is applicable to DeFi/ cryptocurrency investments:

This means that the longer a decentralized application (dApp) has been successful, the more likely it is to continue being successful, emphasizing the importance of considering the age and success of dApps when making investment decisions.

This is even more true, when the dApp has been through the recent bear market and functioned correctly. Keep this in mind when using a dApp.

How to apply DeFIRE

As an investor on the FIRE path, it is important to focus on cutting costs, wealth creation, and wealth preservation.

One way to achieve wealth creation is by investing in cryptocurrencies such as Bitcoin, Ethereum, and other blue-chip altcoins with strong fundamentals. However, it is important to perform due diligence on these altcoins to choose the ones that align with your individual risk-reward preferences. This strategy requires patience as the value of these assets can be volatile in the short term but historically have shown significant long-term growth.

However, after accumulating cryptocurrency for the upcoming bull market the most important questions lies ahead:

What are you going to do when the next bull run in cryptocurrency finally pops?

Are you going to cling on through another bear market or are you going to do something more sensible with your money?

There are various ways to earn passive income from crypto, including staking, liquidity provision, lending, yield farming, among others. These strategies require appropriate crypto assets and a non-custodial wallet, with MetaMask being the most popular option.

In this article, I will only focus on the lower-risk DeFi strategies such as staking native assets and lending as these strategies are more aligned with FIRE.

Staking native cryptocurrency assets

Staking remains a popular method for earning money in DeFi. Currently, $203.2bn are staked, which is ~12% of the total cryptocurrency market cap (~$1.7tr).

It involves depositing cryptocurrency tokens into specialized wallets to help secure the network and validate transactions, in return for receiving rewards. Staking is the practice of locking digital tokens to a blockchain network to participate in the network's consensus mechanism, such as Proof of Stake (PoS), and earn rewards, usually a percentage of the tokens staked.

The main advantage of staking is that it requires only a single asset, making it ideal for investors with long-term conviction in an asset.

Any blockchain that uses the Proof of Stake (PoS) consensus mechanism enables staking. In the context of staking, there are two main roles: validators and delegators.

Validators run nodes responsible for validating transactions, which requires more capital and technical efficiency. Delegators, on the other hand, delegate their stake to a validator node. Validators receive rewards directly for their validation efforts, while delegators receive rewards indirectly through the validator they delegate to, sharing a portion of the validator's reward.

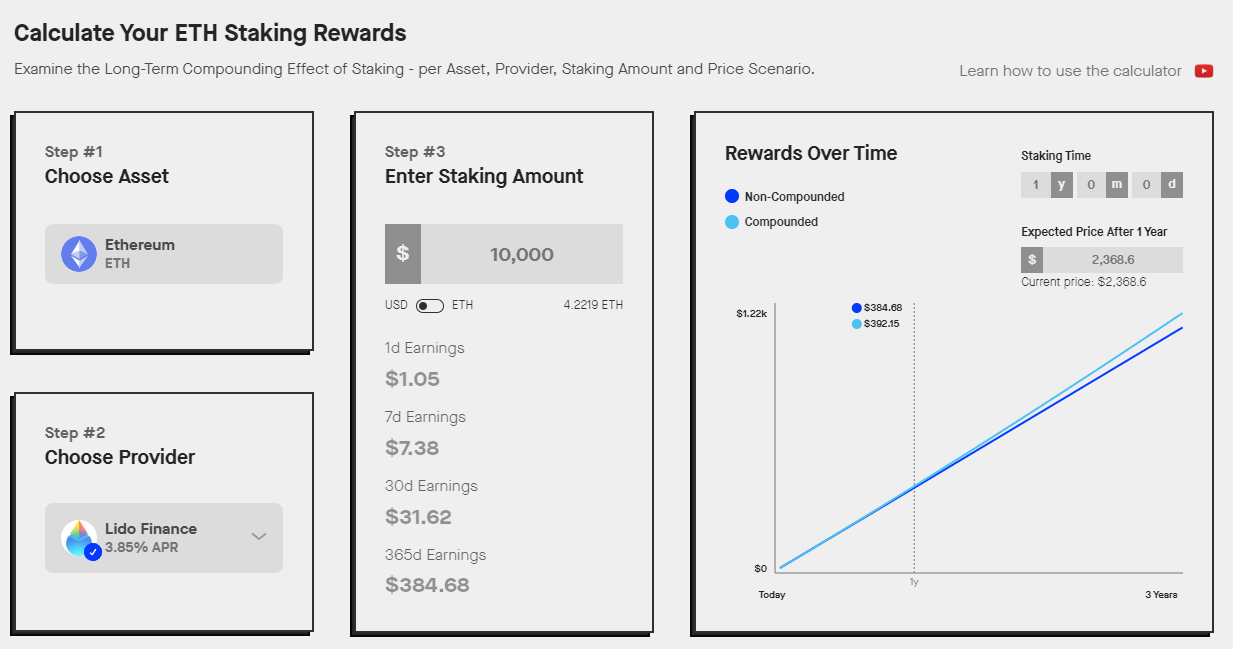

The site Staking Rewards provide a comprehensive overview of various cryptocurrency assets that can be staked, along with a calculator to estimate potential returns. For instance, if you stake $10,000 in Ethereum via Lido Finance, you can expect to receive a 3.85% annual percentage rate (APR).

Staking offers a straightforward way to generate passive income and contribute to the security of a blockchain network. However, it exposes participants to the volatility of the staked asset and often involves lock-up periods, which can affect liquidity.

As a FIRE investor, you desire to replicate dividend-generating stocks, which are frequently mentioned in the FIRE community. Staking cryptocurrencies is one method to accomplish this. However, dividend stocks tend to be less volatile than cryptocurrencies, posing a challenge for FIRE investors who want to invest and stake their cryptocurrencies.

To address this issue, you are looking for a stable asset that offers a sustainable fixed-rate of return and that is where stablecoins come in.

Stablecoins

Stablecoins are a type of cryptocurrency designed to maintain price stability by being pegged to other stable assets such as a fiat currency (e.g., USD).

They were created to reduce the volatility of cryptocurrencies and provide a reliable medium of exchange. Stablecoins have become an essential component of decentralized finance (DeFi) and can be a potential solution for FIRE investors seeking less volatile assets to invest in or stake.

Stablecoins constitute the largest portion of decentralized finance and have a clear product market fit, with two of the top 10 cryptocurrencies by market cap being stablecoins. There are currently around 98 stablecoins listed on CoinGecko, with the top 3 stablecoins capturing 92.4% of the total stablecoin market ($57.8bn).

Stablecoins use various stabilization mechanisms to maintain their peg, such as full collateralization, where the coin is completely backed by valuable assets that users can redeem their assets for. USDT and USDC are backed by cash and cash-equivalent real-world assets (RWA), while DAI is backed by a basket of on-chain assets like ether and USDC.

Lending

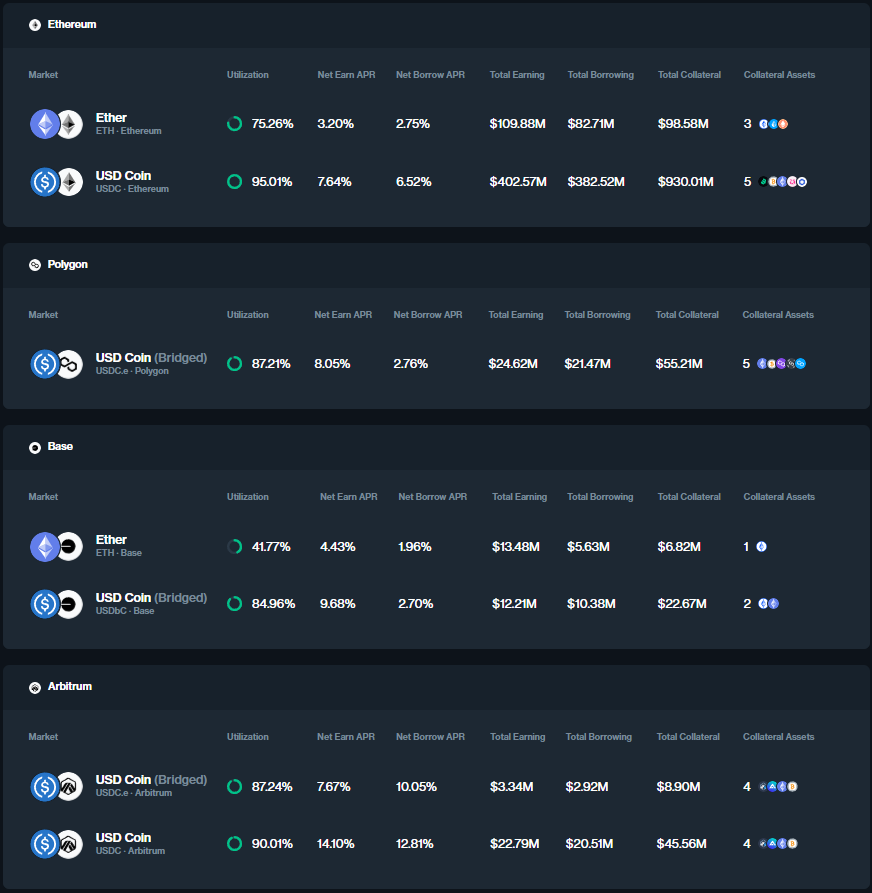

DeFi lending, similar to traditional bank lending, allows users to deposit funds into smart contracts and earn interest from borrowers. It offers advantages such as permissionless access, lower fees, and higher interest rates compared to traditional loans.

Unlike traditional loans, DeFi loans are permissionless and over-collateralized, making them safer. A crucial factor for investors is the utilization rate.

This measures the percentage of borrowed funds in the lending pool compared to the total available for borrowing. A higher utilization rate indicates strong demand for loans, leading to higher interest rates for lenders and higher borrowing costs for borrowers

DeFi applications like Aave, Compound, and Maker focus on connecting users who seek funds (borrowers) with others who want to bring productivity to their idle capital (lenders). They achieve that by allowing lenders to generate revenue on their digital assets and borrowers to access liquidity without selling their holdings.

In contrast to centralized crypto lending platforms like Gemini and Coinbase, decentralized lending markets work permissionlessly through smart contracts, meaning that taking loans, depositing and withdrawing funds, yield distributions, and liquidations are all conducted through code and without the presence of a central authority.

Stablecoins, such as USDC, can be used in low-risk DeFi strategies like stablecoin farming to earn interest while maintaining asset stability. This involves lending out or staking idle stablecoin holdings to generate returns and reduce the risk associated with volatile cryptocurrencies

One way to earn interest on supplied stablecoins is via the decentralized lending platform Compound. However, it needs to be noted that the rates here can fluctuate based on supply and demand.

DeFi lending is a simple and flexible source of passive income and it drives real-world economic activity. However, it is essential to be mindful of the eligibility of digital assets for lending and the prevalence of variable interest rates, and to consider the sustainability of yields based on on-chain data.

Don’t trust, verify - Where does the yield come from?

The soundest advice for those willing to deposit their funds to a decentralized money market is to make sure the case for the sustainability of yields is supported with readily available on-chain data.

The great collapse of TerraUSD (UST), Anchor Protocol and Terra Luna reminded everyone always to check the source of yields.

To generate a yield, protocols distribute income to token holders, which can come from various sources:

Token Issuance/Staking: The most common ‘income’ comes from token issuance. Protocols issue new tokens to validators to secure the network, providing them with revenues that offset their costs and enable them to make a profit.

Transaction Fees: Validators receive fees for executing transactions, which can increase with higher activity on the chain.

Burning: Tokens are removed from circulation. Although this is not an income paid to validators, reducing the number of tokens in circulation, all else being equal, increases the fiat value (e.g. dollar) of the token.

Maximal Extractable Value (MEV): This is an additional form of income for validators, earned by opportunistically arranging the order of transactions.

Achieving fixed-rate returns

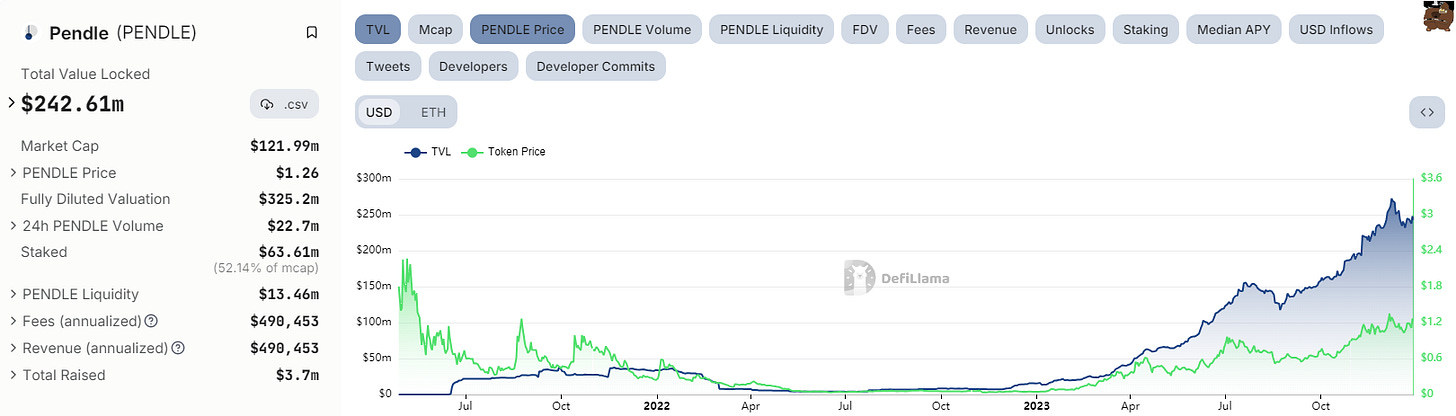

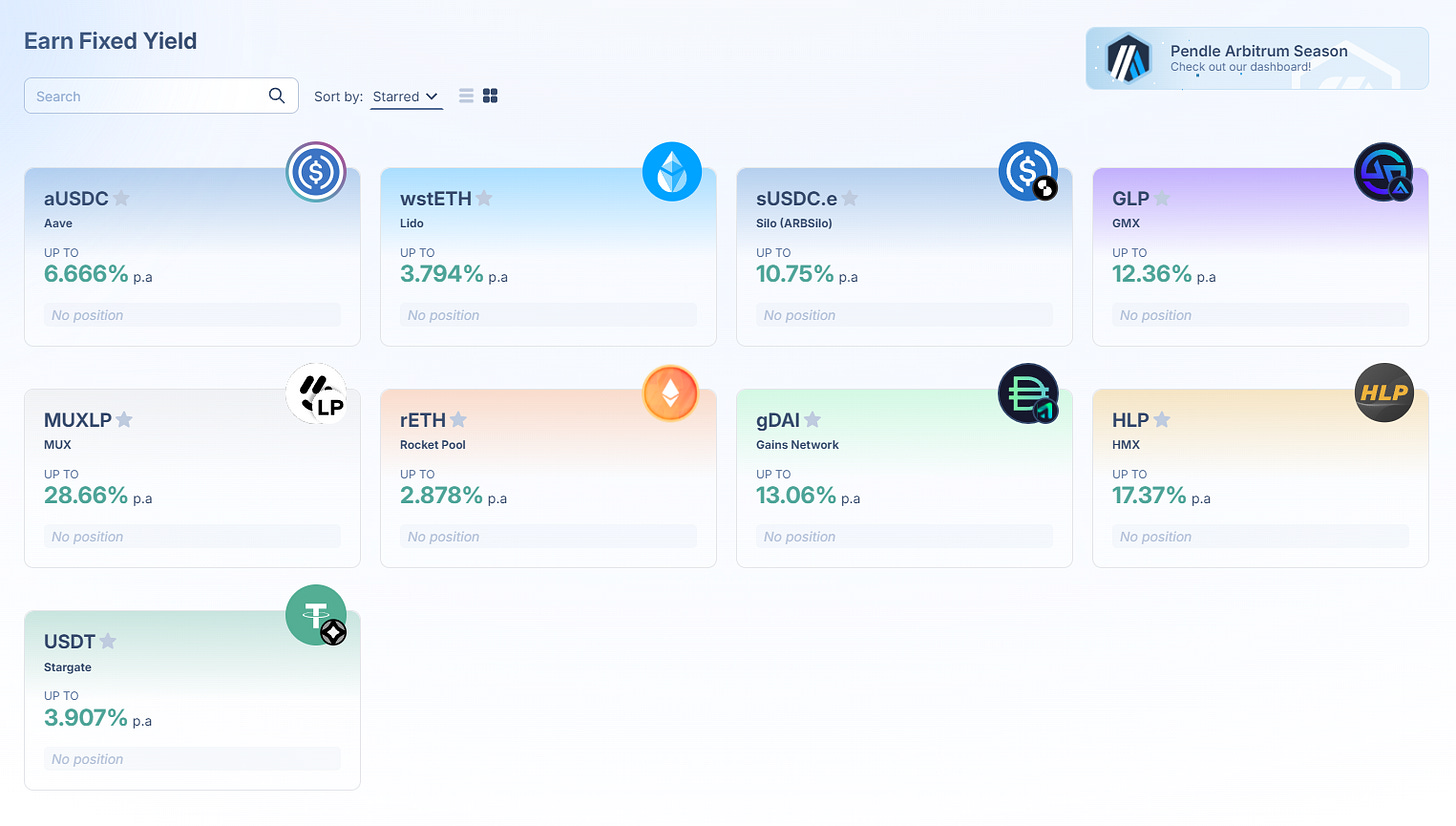

Another example is Pendle Finance. Pendle Finance is a decentralized finance (DeFi) protocol that offers users the ability to trade and receive fixed rates of interest on lending protocols and liquidity pools. It is part of a new wave of fixed-rate projects in DeFi called 'yield tokenization'. The TVL has reached an impressive $242 million and has been consistently trending upwards since the beginning of 2023.

Pendle Finance v1 was launched in 2021, but the initial user experience was complex and overwhelming. As a result, Pendle Management redesigned the protocol mechanics and automated market maker (AMM) user experience while still providing fixed rates for users.

Pendle Finance v2 was launched in November 2022, featuring a streamlined and straightforward interface with two user interfaces: Pendle Earn (simple UI) and Pendle Trade (more advanced UI and yield strategies for experienced traders). In September, Pendle expanded their product offering to include Real World Assets (e.g., tokenized T-bill products).

The yield tokenization sector is relatively new and underutilized compared to established DeFi sectors such as lending, decentralized exchanges (DEXs), and derivatives. As a result, it is essential to exercise caution when using the yield tokenization protocol, keeping in mind the Lindy effect.

Closing thoughts

DeFIRE offers more flexibility, transparency, and the potential for higher returns, making it a compelling addition to traditional financial and retirement planning (e.g. FIRE) strategies.

By incorporating digital assets and decentralized finance (DeFi) into your investment strategy alongside traditional methods, such as investing in index funds, you can benefit from increased control, security, and the potential for higher returns.

Hence, I strongly encourage you to explore and consider DeFi as a complementary approach to traditional financial and retirement planning strategies. A good starting point is setting up a non-custodial wallet and interacting with these protocols using a small amount to familiarize yourself with the DeFi landscape.

It's important to note that this article only scratches the surface of the various DeFi strategies and protocols available. As you continue your journey, always prioritize due diligence and risk management to make informed investment decisions.

Don’t forget to hit the “♡ Like” button!

Likes are a big deal. They serve as a proxy for new visitors and feed into Substack’s algorithm that distributes my articles to all Substack readers.

Better yet…share this article with your crypto community.

Follow me on Twitter @anthoniemeijer for my latest takes.

If you enjoyed this thread and want to receive similar posts in the future, please subscribe below.

Disclaimer: The information provided here is for educational purposes only and should not be financial decisions. Any actions taken based on the information presented are at your own risk. considered as financial advice. The content is intended to provide general information and should not be relied upon as the basis for any financial decisions.